11

december

2023

Weimar-beleggen & Depressie

Fortunes to be made and Fortunes to be lost

De Grote Amerikaanse deflatie-Depressie van de jaren 1930 vernietigde het spaarwezen en de vermogens. De dollar steeg in waarde.!

De huidige crisis is echter een Weimar stijl (hyper)inflatie die zal verlopen zoals de Weimar depressie: de dollar en alle currencies zullen hun helemaal waarde verliezen!

(Er bestaat een fundamenteel verschil tussen de 2 cycli!)

De Weimar crisis kwam en met een hoge werkloosheid en met hyperinflatie.

Met een geldhoeveelheid die jaarlijks groeit met 35% en meer, en met banken die in een poging om het systeem levend te houden, de markten met miljarden fiat geld overspoelen, razen we als een ongecontroleerde trein recht naar een Hyperinflatie zoals Duitsland deze tijdens de Weimar revolutie ervaarde. Venezuela beleeft dit de dag van nu nog steeds. (klik hier voor de CDO subprime plaatjes).

Gedurende de Weimar was het drukken van vers geld gelimiteerd door het aanbod van “papier en inkt”. Bepaalde landen zoals Polen gebruikten max. 1 tot 2 kleuren. In Duitsland was het uiteindelijk goedkoper bankbiljetten te gebruiken om de kachel aan te maken en je huis te verwarmen dan ermee hout en kopen te kopen.

Vandaag gebruiken en scheppen de Nationale Banken en de banken steeds meer 'digitaal geld'. Met andere woorden, enkel de computer beperkt de hoeveelheid geld die men kan scheppen.

Daarom worden straks niet enkel bankbiljetten waardeloos, maar ook al het digitaal geld (banktegoeden, spaarboekjes), schatkist certifikaten, obligaties, alle financiele producten, …). VIJFTIG EURO zal 50 euro blijven, het biljet zal echter weinig of geen koopkracht meer hebben.

Onroerend goed zal jammer genoeg de dans ook niet ontspringen. Immers, tengevolge van de hoge inflatie zal de koopkracht van de burgers wegsmelten. Bovendien, dient men er rekening mee te houden dat de overheid onder druk van het volk (en om stemmen te kopen) de huren zal blokkeren. Erger nog, en dit gebeurt nu reeds in de USA, dient men niet langer maandelijks te huur te betalen en mag de eigenaar de niet-betalende huurder(s) niet uitwijzen .

De eigenaars zijn dus het direct slachtoffer geworden van de hogere onderhoudskosten van hun panden en niet-betalende huurders. Om het nog allemaal erger te maken, gaan er nu zelf stemmen op die erop wijzen dat de Overheid straks eigenaars zal verplichten 'gratis' vluchtelingen te herbergen.

"Beleggen, beter “je vermogen veilig stellen”, is dus een andere oefening geworden. Dit omdat de traditionele financiële beleggingsinstrumenten steeds meer falen."

Tijdens een periode van zware inflatie, kopen burgers om het even wat (vooral LOCG), gewoon om hun waardeloos geld kwijt te spelen. De burger zal, naargelang deze steeds meer begint te beseffen dat hij bedrogen wordt, en teneinde zijn koopkracht zo goed als mogelijk proberen te redden, steeds meer en sneller zijn 'papier en digitaal geld” omwisselen voor ECHT GELD en andere activa.

Dit gebeuren heet men de wet van Gresham: het slechte geld verdringt het goede geld uit circulatie. Daarom zal er straks erg weinig Goud en Zilver als geld worden gebruikt. De burger zal eerst al zijn andere geld-middelen gebruiken en pas op het laatste ogenblik (eens het niet anders meer kan) eerst zilver en nadien goud gebruiken om te betalen.

De geschiedenis en ervaring leren dat tijdens periodes van zware inflatie, de beursindexen verder blijven stijgen. Dit omdat aandelen participaties zijn in 'echte activa'. Ze stijgen echter minder snel dan het goud en het zilver. Wie toch in aandelen en obligaties blijft zitten, verliest bijgevolg elke dag aan koopkracht. Bovendien loop je dan het risico dat de overheid de financiële markten SLUITEN (Bank Holiday) en je dan niet langer je effecten kan verzilveren.

"Wie beslist in onroerend goed te blijven zitten, komt in een situatie terecht waar hij of zij onmogelijk het goed nog kan verkopen, dit terwijl de kosten en taksen blijven stijgen."

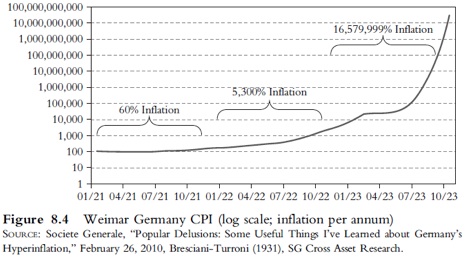

Weet dat tijdens de Weimar van 1919 tot 1923 de Duitse economie niet continu in activiteit daalde. In 1920 stabiliseerden de economie en de Duitse mark zich gedurende ongeveer 6 maanden. *De wisselvoet van de Duitse mark steeg toen zelf zo hard dat de prijzen van de ingevoerde goederen met 50% daalden. De inflatie-index bleef tijdens die periode onveranderd en de wisselvoet van de Duitse Mark steeg tot ongeveer 1US$ voor 69 Duitse marken. Op dat ogenblik had de Weimar Regering een stabiele munt kunnen in leven roepen. Maar in plaats hiervan, bleef de overheid de hoeveelheid geld in omloop verhogen. Dit was erg inflatoir en resulteerde uiteindelijk in de hyperinflatie van 1923.

*Dit is net hetzelfde wat we de voorbije maanden gezien hebben in de USA: de wisselvoet van de Dollar steeg en de prijs van grondstoffen ( commodities) daalde.

"Tijdens de maand juli van 1922, daalde de wisselvoet van de Duitse mark tot 300 marken voor $1; in November van hetzelfde jaar tot 9,000 voor $1; Tijdens de maand Januari 1923 tot 49,000 voor $1; in Juli 1923, tot 1,100,000 DM voor $1. De wisselvoet viel tot 2.5 trillion marks voor $1 in November 1923. De wisselvoet schommelde wat van stad tot stad.

De drukpersen waren niet meer te stoppen. Er werd dus dag en nacht geld gedrukt. De detailprijzen begonnen met een razend tempo te stijgen. De menus in drankgelegenheden en restaurants dienden voortdurend aangepast. Een student aan de universiteit van Freiburg bestelde een kop koffie. De prijs op het menu bedroeg 5.000 marken. Hij dronk 2 kopjes. Toen de rekening kwam, diende hij 14.000 marken te betalen. Toen de man zijn ontevredenheid uitte, kreeg hij als antwoord dat indien hij geld wou besparen, hij in de toekomst best ineens 2 kopjes koffie bestelde.

Alhoewel de drukpersen van de Reichsbank dag en nacht draaiden, slaagde men er toch niet in om genoeg geld te drukken. Steden en provincies begonnen uiteindelijk hun eigen geld te drukken.

Arbeiders werden elke dag om 11 uur in de morgen betaald. Om 11 uur, nadat de sirene loeide, verzamelden alle arbeiders zich op een plein voor het fabrieksgebouw. Daar stond een kamion nokvol volgeladen met geld. De hoofdkassier en zijn assistent klommen bovenop de vracht geld. De namen van de arbeiders werden afgeroepen en ze gooiden telkens een aantal bankliassen naar de persoon in kwestie. Zodra iemand zijn salaris ontvangen had, liep hij/zij naar de dichtstbijzijnde winkel en kocht met het loon gewoon wat er te koop was.

Onderwijzers werden om 10:00 a.m., betaald. Zij kwamen met hun geld op de speelplaats waar familieleden de bankliassen in ontvangst namen en naar de winkels holden. Banken sloten immers al om 11:00 a.m.; de ontevreden bankbedienden staakten vaak.

De vlucht weg van het geld die was begonnen met het kopen van diamanten, goud, landhuizen en antiek breidde zich nu uit tot kleine en bijna nutteloze voorwerpen -- bric-a-brac, zeep, haarspelden. In het gezagsgetrouwe land was er steeds meer kleine diefstal. Koperen pijpen en messing armaturen waren niet langer veilig. Benzine werd uit auto's overgeheveld. Mensen kochten dingen die ze niet nodig hadden en gebruikten deze om te ruilen -- een paar schoenen voor een shirt, wat serviesgoed voor koffie.

In Berlijn heerste een "heksensabbat" sfeer. Prostituees van beide geslachten zwierven door de straten. Cocaïne was de modieuze drug. In de cabarets konden de nieuwe rijken en hun buitenlandse vrienden dansen en geld uitgeven. De uitgever Leopold Ullstein schreef: "De mensen begrepen gewoon niet wat er gebeurde. Alle economische theorieën die ze hadden geleerd voorzagen niet in het fenomeen. Er was een gevoel van totale afhankelijkheid van anonieme krachten -- bijna zoals een primitief volk in magie geloofde. "Toen het briefje van 1000 miljard Mark uitkwam, namen weinigen de moeite om het wisselgeld te aan te nemen toen ze het uitgaven.

Tegen november 1923, met één dollar gelijk aan één biljoen mark, en was de ineenstorting compleet. De munt had geen betekenis meer. Deze keer is hetzelfde lot beschoren voor de meeste currencies (Dollar, Euro, Yen, Aussie, Can-Dollar, Sterling,..). In het biezonder die currencies uitgegeven door Centrale banken die de DOLLAR aanhouden als reservemunt.

© De inhoud van dit rapport mag niet worden gekopieerd, gereproduceerd of verspreid zonder expliciete schriftelijke toestemming van Goldonomic

- Tags: hyperinflatie, weimar, werkloosheid